Passive income is the income earned that requires little to no ongoing time requirement after the initial work is complete. These types of income streams are becoming more popular as people are realising there’s a way you can earn money effortlessly whilst you sleep and enjoy life.

To some, this concept may sound crazy, although if you ever want to retire early, if at all, it’s essential you understand the different strategies to generate passive income.

Below I will go into detail on some popular passive income ideas as well as some obscure and unique strategies.

This will give you an in-depth overview, allowing you to see how you can get started right away and utilise the power of compounding for your own gain.

Contents

High-Yield Bank Accounts

This type of passive income is one of the most used and easily accessible as the vast majority of people have a bank account. This is where a bank will pay you interest on the amount of money you have deposited in an account.

This interest rate banks offer usually varies from 0% up to around 5%.

Unfortunately, most people don’t shop around and especially in the banking industry, loyalty is not rewarded.

A significant portion of people’s wealth is sitting in bank accounts earning 0% to 0.25% which is losing value from inflation.

The cost of new customer acquisition for a bank is over £250 in the UK & $300 in the US. This is the amount of money a bank is willing to pay to acquire you as a new customer.

This means banks are willing to offer outrageous new customer deals to get people on board. This can be anything from a 4 year 16-25 railcard to entice young budding students, a direct £175 cash deposit or a high yield interest account.

The key is to know your worth to banks and leverage this to your gain.

Even finding a bank account with a 1% interest rate compared to one on 0% can earn you thousands over your lifetime with just an hour of looking around and switching. Easy passive income for beginners, a nice quick win!

Start hunting for a better bank account today and start making your money work harder for you.

Online Assets & Affiliate Marketing

As this is a resource dedicated to passive income ideas for beginners, I want to provide options that do not need much, if any money to get started.

Time is one of the most valuable assets that anyone has, especially when first starting as typically at this stage having a few hundred thousand lying around to invest simply isn’t an option.

Although this method does involve a fairly high amount of time to set up at the start, once created this source of income has the potential to bear fruit for years or even decades to come.

So what is an online asset?

An online asset is typically anything online that you can use to drive online web visitors and make money from that traffic.

To generate long term sustainable traffic you need to build a platform that creates value for people. This can be anything from a website, a YouTube channel, an Instagram account or even an email list.

This isn’t an extensive list of options as I’m sure you can think of a few more off the top of your head.

So how do you make money I hear you ask!

As your platform grows, more people will view your content, whether that’s pictures, videos, articles, podcasts or something else.

With all these visitors, companies start being interested in advertising on your platform to help them grow brand awareness and generate sales. This can be done in a variety of different ways.

Affiliate Marketing

One of the most popular methods is through affiliate marketing. This is where you link to a product that is sold by another company and if someone buys their product, you get a percentage of the sale as a commission.

Sell Leads

You can also collect and sell leads. If the product you are linking to needs to be specifically tailored to a person’s needs and isn’t a quick online sale, collecting the information of people that are interested in a particular product or service may be a more effective option.

You can then sell this information to companies who will be willing to pay you per lead or individual contact you provide to them. They then they use this information with their sales teams to convert those into sales.

Display Ads

Another way of generating money through a platform is through display ads. This effectively works like a billboard where advertisers either pay per click or per view. When buying or selling views it is often referred to as CPM (cost per mille) meaning the cost per thousand impressions.

This can be done through many online assets. If you have created a website, you can put up banner advertising or if you have a YouTube channel or podcast, you can play adverts at specific times during the content.

Sell Your Own Product or Service

You can also bypass the need for a third party and sell your own product or service. Whilst this will take more time to set up and manage going forward, it will mean you can keep a larger slice of the profits.

Depending on how you structure your business you can still make this a passive income stream.

As an example, if you made informational products, such as an online course which helped people solve a particular problem, or delivered a service but outsourced the operational activities, it may not be as demanding on your time as you would think.

Key Tips

The key is to centre your content around a specific topic.

This can be anything from baking, travel, fitness or as you can see from this website, finance.

Making your content specifically around one topic will help you tailor your content towards the needs of the person. For example, if someone comes to this website, I have a decent idea that they’re interested in learning more about finance and making money.

This means I can create content that will continue to help them and hopefully encourage them to return at a later date.

This also helps the advertisers as they know they need to advertise their product or service to a specific audience and are willing to pay a premium to do it.

Hopefully, this gives you a high-level understanding of the benefits of creating online assets.

I appreciate this isn’t a truly passive income source, especially at the start as it takes a lot of effort to get off the ground. Although once set up this is why it’s often known as online real estate, as it’s an asset you can earn money from for years to come.

Start building your online asset today.

Stock Market Dividend Investing

Dividend investing involves buying shares in an organisation, effectively owning a piece of that company. As an owner of the company, you are then entitled to a share of the profits.

The amount of money that is distributed as a dividend does differ between companies.

A company that is still growing rapidly will usually have a very low dividend or choose not to pay one at all. This is because they may want to prioritise internal investments that will yield a better return to shareholders in overall company value.

Typically companies that have a high dividend are more mature and are well established in their markets. Their ability and willingness to pay a dividend consistently is an indication of their financial strength.

Companies that are well known for their stable high dividends include GlaxoSmithKline (GSK), HSBC (HSBA), Unilever (ULVR), Pfizer (PFE), Wells Fargo (WFC) and 3M (MMM).

Of course, this isn’t an extensive list and if you’re interested I do encourage you to do your own research.

Just to note, the S&P 500 has also had roughly a 2% historical dividend yield, so you can also earn dividends through index funds that track the whole market.

If you want to find and review different stocks and markets I recommend using Google Finance Stock Screener.

With the recent stock market reduction, this has also triggered a spike in yields and the price of stocks has dropped. This is especially true for oil companies that are well known for having high dividends.

As an example, the dividend yield for Royal Dutch Shell (RDSB) went above 9% after a 20% reduction in the share price.

To get started on your dividend investing passive income journey you can buy company stocks and funds through online brokerage accounts.

Stock Market Growth Investing

Actively investing in individual stocks can be very time consuming, so rank low when choosing a form of passive income from investments. Although there are many different options where you can participate in the stock market growth without it being demanding on your time.

Low-cost index trackers are an easy and effective way to own a piece of the whole market and allow your investment to grow in line with the market.

One of the best ways to accelerate compound growth and get a higher investment return is to pay less in fees.

Market disruptors like Vanguard have helped drive down the cost of investing, with average ongoing costs of just 0.20%.

Historically the fees involved to invest in the stock market were significantly higher, severely limiting your returns and ability to compound your investment over time. It’s understandable why Vanguard now manages close to $6 trillion in assets.

Remember, past performance is not an indicator of future outcomes. There’s always a risk that your investments can go down in value, as has been very clear from the recent stock market volatility.

This type of investment is ideally suited to someone with a time horizon of at least 5 years, ideally longer. This helps to average out any short term volatility and give a higher likelihood for positive gains.

The key is to make sure to do your research and understand your risk tolerance. Although with the stock market having a strong track record with roughly a 7% average annual return it represents a significant opportunity.

As a result, make sure not to rule out stock market growth as one of your passive income ideas.

To get started you can buy company stocks and funds through online brokers.

Fixed Income & Bond Investing

These types of investments are usually used as a defensive portion of peoples portfolios and the US 10-year bond yield is often referred to as the risk-free rate across the market as it’s backed by the US Government.

As interest rates have been decreasing for over 30 years and are now at a record low with the US 10-year bond yield at roughly 0.7%, the price of bonds have increased. If interest rates start to increase, the price of the bonds will most likely start to decrease.

I agree this logic doesn’t seem to make sense. What, so I have to pay more for a lower return?

For a more detailed understanding of exactly how it works, the Securities and Exchange Commission (SEC) has gone into a ton of detail to explain exactly why here.

Although as a quick summary it’s because as interest rates rise, new bonds that are issued have a higher rate of return.

As an example, you could hold a bond that has a 1% return that you bought for $1,000 and a new bond is issued at 1.5% with a face value of $1,000. If you wanted to sell your bond, investors would not be willing to pay as much so the price decreases to match the current 1.5% return that is being offered in the market.

Although as long as you hold the bond to maturity and don’t sell it, you’ll maintain your original rate of return. This is because you’ll continue to receive your regular coupon payments and get your initial principal back. As long as the issuer doesn’t stop paying that is, so make sure to check the bond rating as a guide for safety.

There are multiple sources of bonds, including Corporate bonds, Agency bonds, Municipal bonds and Treasury bonds. Each of these carry different risk ratings, so be sure to choose the one that’s right for your situation.

As a source of passive income, this strategy is useful for dependability and security.

This is why this type of investment is also commonly used for pensions. As long as high-quality bonds and fixed income sources are selected it’s a very low-risk form of income with minimal volatility.

To get started, bonds can be purchased through most online brokerage accounts.

Real Estate Crowdfunding

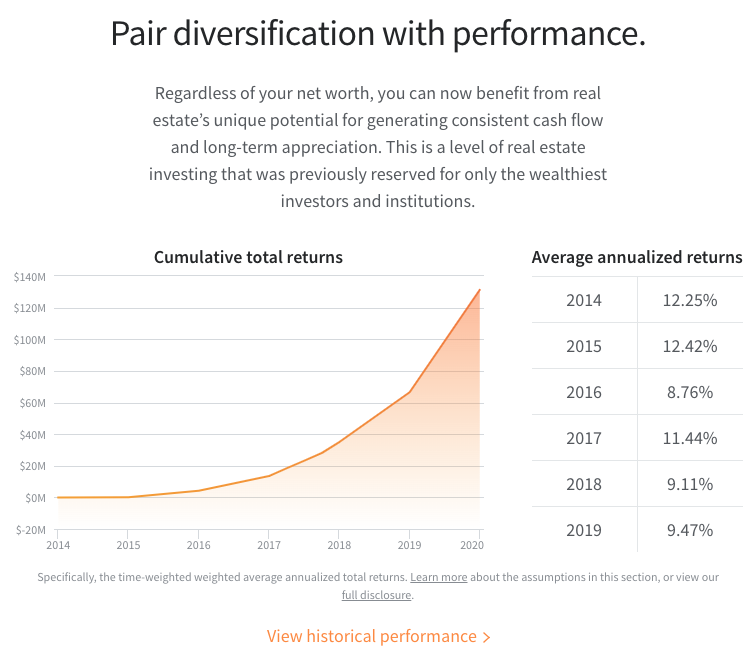

This is one of the fastest-growing investment types as crowdfunding is now enabling everyone to be able to invest in high yield commercial and residential real estate projects.

Historically these were only available to institutional investors or ultra-high net worth individuals due to the size of the capital required and the initial set-up costs from due diligence and legal fees.

With annualised returns from 7% to 13%, it’s easy to see why these investments are gaining in popularity, especially with the recent huge volatility in the stock market.

With these investments, unlike peer to peer lending, your investments are secured against the physical asset. This helps to significantly reduce the risk of this asset class.

If you want to get started, one of the best platforms is Fundrise. It was established in 2012 and has a solid track record of returns, as shown above.

It’s free to sign up and review their various investment options. There is something for everyone, from investments that favour supplemental income or those aimed at significant long term capital appreciation.

For awareness, I just want to highlight that one drawback of this investment class is that investments typically have long time horizons. This may not be a concern for some, although if you are hoping to cash out and use the proceed for a big purchase in the next year or two, I would recommend other types of investments.

This asset class is typically for those that are looking to invest for a minimum of 5 years. This is not to say that your investment is illiquid as you can still get access to your money, although it may take a few weeks up to a few months.

On a positive note, this also means this asset class rarely suffers from huge fluctuations due to panic selling like publicly traded stocks and real estate investment trusts (REITs).

If you’re interested, have a look at Fundrise now.

Peer to Peer Lending

Although still a relatively new industry, this method of earning passive income is proving very stable and lucrative.

The concept behind it is where individual investors are connected directly with borrowers. This allows investors to get a better rate of return for their investment and investors can get a better interest rate than a bank would usually offer or provide an alternative source of finance. This effectively cuts the bank out of the process.

There are several companies in the industry including LendingClub and Funding Circle. Cryptocurrency companies are also starting to expand into this market as well such as BlockFi that lend out your cryptocurrency assets.

Each company has their own criteria for lending money with differing risk profiles. Many platforms also split your investment across multiple lenders to help reduce the risk if one was to default for any reason.

Renting Physical Real Estate

Whilst this is one of the least passive income sources on the list, it is within your control to determine how much time you spend.

When it comes to buying and renting real estate, you have the option to outsource most of the activities. Even buying the property if you look into purchasing Real Estate Investment Trusts (REITS) or Real Estate Crowd Funding mentioned above.

Although this method was mainly aimed at owning and renting property you own and manage yourself.

One of the most common ways to make this style of investment more passive is to utilise a property management company. They usually take a fee which is around 9-12% of the rent each month.

For this fee, they effectively manage the property on your behalf. So they liaise with the tenants, fix any minor issues that arise and collect the money each month.

Of course, you could do this yourself and save the 9-12% fee, which many people do. Although depending on your goals and other commitments this may be a small price to pay for peace of mind knowing your investment is being managed for you.

Credit Card Rewards

This is often a relatively overlooked method of earning passive income as it doesn’t come with those eye-catching huge figures. Although when you run the numbers, the return on investment for both time and money is excellent.

As an example, a free credit card from American Express offers around 1% cashback in the UK and can be even higher in the US and some other countries. Also if you want to pay for the more premium cards, the rewards are also more extensive.

It will only take you a few minutes to sign up, then all you have to do is create a direct debit and you’re automated passive income stream is ready to go.

This year I’ve made close to £200 in rewards just off this card and there’s still a month or two left. Then when you factor in I set up the card a number of years ago and just spent money as I otherwise would, you can see how this is a brilliant passive income stream.

This isn’t the only card with great rewards, although American Express is renowned for their market-leading rewards.

If you’re worried about whether or not you’ll be accepted due to your credit score then make sure to check out this guide that explains how to get an excellent credit score.

Which of These Passive Income Ideas is Best for Me?

Completely understand where you are coming from. With so many choices it can be hard to start or choose which one is right for you.

In my opinion, to truly answer this question for yourself you need to understand your goals.

For example, if your goal is to earn an extra £100 per month so you can effectively go on holiday for free each year, your strategy and plan will be completely different compared to someone wanting to earn £5,000 per month so they can retire early or quit their job.

You also need to have a clear understanding on what assets you have. Some of these opportunities require a decent amount of capital to get a meaningful amount of passive income.

Before you say you don’t have any assets, or all your money is tied up in your house, one of the main assets people forget about is time.

Leveraging your time to either generate more income or save money will help accelerate the amount of money you can generate through investing.

This can be investing time in creating an asset, such as a website or product, or devoting your time to actively reducing your expenses, allowing you to invest more in passive income sources.

Also, remember that you are not just restricted to just one of these passive income ideas. Creating multiple passive income streams will help you to reduce the risk of relying on one or two sources and help build resilience in your earnings.

Remember the Tax Implications

Passive income can be earned in many different ways. As a result, how they are taxed can vary dramatically.

Without careful consideration of how taxes will come into play can cost you years of compound growth. Remember, it’s not what you earn that matters, it’s what you keep.

If you are unsure about anything, I recommend thoroughly researching and talking to a Financial Advisor that will be able to tailor advice to your specific situation.

Ensuring you are investing and earning in the most tax-efficient way will help you reach your passive income goals faster.

Key Advice for Building Passive Income

My key advice for earning passive income is to invest early and often, with an emphasis on thinking long term. Whether this is regularly investing the time building an asset such as a website, product or business, or dedicating a percentage of your income towards compounding investments.

One of the main determining factors for success in almost anything is long term discipline executing tasks that are aligned to your goals.

Start your journey today.

Hi, I’m John. I’ve always had a keen interest in Finance, so much so that I’ve made a career out of it! This site is a place where I can share everything I’ve learned as well as give me the excuse to research certain topics.

Check out my about page for more info.